Terry

O’Brien, Managing Director, Simplot Australia, was highlighting the massive

challenge in Australia relating to any food manufacturing at the recently held

Global Food Forum in Sydney.

He was

reported as saying ‘I don’t think it’s a coincidence that there’s very few true

food processors on the stock exchange. It does require pretty patient money,

because unlike what a few people have said recently, it’s not a licence to get

rich in the food processing industry. And we’re impacted by agricultural

issues, just like anyone else and like the farmers. So what’s tended to happen

in Australia is you have very few, really, ASX-type funded companies. You have

international conglomerates who really just have the aim to keep their brand on

a global basis here, so they have subsidiaries that tend to be funded from

offshore. And then you have the big private companies. And if you look at our

company, Simplot, we’re American owned, but it’s a family company.’

|

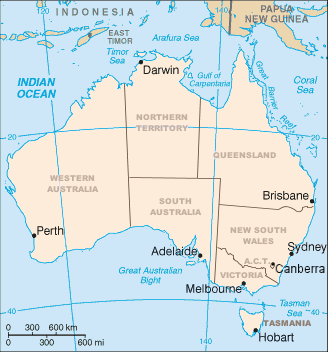

| A clickable map of Australia's states and mainland territories (Photo credit: Wikipedia) |

The

Simplot chief added ‘So in Australia we’re constantly bidding for our capital

from our international parent against the other businesses that they have in

other parts of the world. And because most of that capital is coming from

reinvestment, our profit performance is the major criteria on which we get our

brownie points when we go and ask for money. So if you look at the last few

years, it’s been a pretty poor scene here in Australia with the non-tradables

cost just climbing and, really, quite a cap on the pricing and the available

profits within the supply chain in Australia.’

‘We’re all

now setting about trying to put a much leaner business in place. We’re finding

it a little difficult to pass that message on to some of the other people who

put costs into our business. It’s going to take a while to change the whole

mentality, and I think government’s one of those things. And I think, you know,

listening today to the two gentlemen (Government Ministers), there’s clearly a

recognition that government has brought costs to this industry. I’m waiting to

see the proof that the new government can do something about that.

When asked

about Australian organisations losing market share internationally Mr O’Brien

reportedly said ’Well, first of all, you’ve got to realise that we are growing;

it’s just the market’s growing quicker than us. So we are losing share, but it

doesn’t mean we’re losing business. But the one that alarms me is New Zealand,

because they have an FTA, for example, in China. And the products they sell to

China that compete with us, they’ve got a 13 per cent advantage on tariff, you

know, from day one. And there’s no way you can overcome that sort of

disadvantage, considering the cost structures of New Zealand versus Australia.

We battle to keep their products, you know, out of our market, just coming

across from New Zealand. So, yes, it does worry me a lot. And there’s been a

few comments. We have to get more of an Asian mentality. We’re not

concentrating entirely on Asia. We’ve got Middle East opportunities as well.

But the point of it is we have tended to not have the – we haven’t had the

money to reinvest into products that are specifically for those markets. We’ve

just tried to sell products that we are comfortable making. And I think you’re

not going to succeed in that pursuit.’

Source [1]

No comments:

Post a Comment